Workers compensation insurance california requirements set the foundation for businesses in the state, ensuring legal compliance and protection for employees. This guide delves into the essential aspects of these requirements, shedding light on key details that every employer should know.

From the legal obligations to coverage details and maintenance tips, this guide covers everything you need to navigate the realm of workers compensation insurance in California seamlessly.

Overview of Workers Compensation Insurance in California: Workers Compensation Insurance California Requirements

Workers’ compensation insurance in California is a crucial form of protection for both employees and employers. This insurance provides benefits to employees who suffer work-related injuries or illnesses, including medical treatment, wage replacement, and disability payments.

Purpose of Workers’ Compensation Insurance

Workers’ compensation insurance aims to provide financial support and medical care to employees who are injured or become ill as a result of their work. It serves as a safety net for workers and their families during challenging times.

Benefits for Employees

Employees benefit from workers’ compensation insurance by receiving prompt medical treatment, wage replacement while they recover, and compensation for permanent disabilities. This insurance ensures that employees are taken care of in the event of a workplace injury or illness.

Legal Requirements for Businesses in California, Workers compensation insurance california requirements

Businesses in California are required by law to carry workers’ compensation insurance if they have one or more employees. Failure to provide this insurance can result in severe penalties, fines, and legal consequences for employers.

California Requirements for Employers

Types of Businesses Required to Have Workers’ Compensation Insurance

All employers in California, regardless of the size or nature of their business, are required to carry workers’ compensation insurance. This includes full-time, part-time, and seasonal employees.

Consequences for Employers Without Insurance

Employers who fail to provide workers’ compensation insurance can face penalties such as fines, lawsuits from injured employees, and even criminal charges. It is crucial for businesses to comply with this legal requirement to protect their employees and avoid legal troubles.

Impact of Number of Employees on Coverage Requirement

The number of employees in a business determines the extent of workers’ compensation coverage required. Even with just one employee, a business must have this insurance in place to ensure protection for their workforce.

Coverage Details and Limits

Coverage Provided by Workers’ Compensation Insurance

Workers’ compensation insurance in California covers medical expenses, disability benefits, vocational rehabilitation, and death benefits for eligible dependents. This insurance ensures that employees receive the necessary support in case of a work-related injury or illness.

Minimum Coverage Limits in California

California law mandates specific minimum coverage limits for workers’ compensation insurance. Employers must ensure that their insurance policy meets these requirements to comply with the law and protect their employees.

Examples of Coverage

Workers’ compensation insurance typically covers injuries sustained at the workplace, occupational illnesses, repetitive stress injuries, and other conditions directly related to work duties.

Obtaining and Maintaining Workers Compensation Insurance

Process for Obtaining Workers’ Compensation Insurance

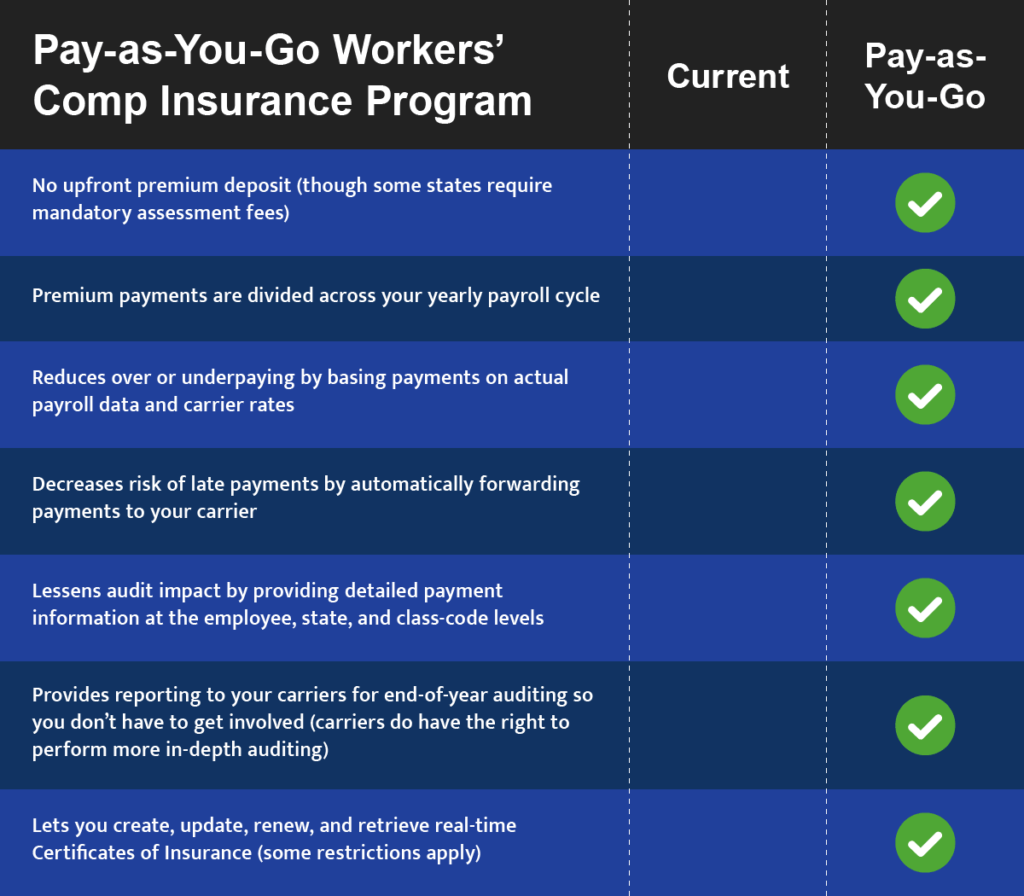

Businesses in California can obtain workers’ compensation insurance through licensed insurance carriers, self-insurance programs, or the State Compensation Insurance Fund. It is essential to compare quotes and coverage options to find the best policy for your business.

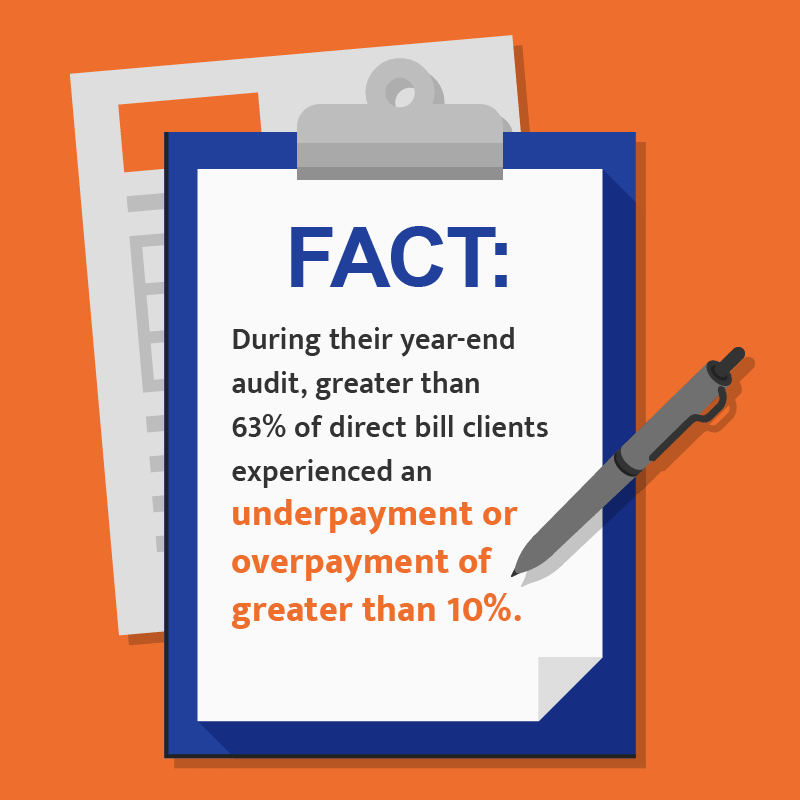

Factors Affecting Cost

The cost of workers’ compensation insurance can be influenced by factors such as the nature of the business, the number of employees, the industry’s risk level, and the claims history. Employers must maintain a safe work environment and follow best practices to keep insurance costs manageable.

Importance of Record Keeping and Compliance

Maintaining accurate records of workplace injuries, insurance policies, and compliance with legal requirements is crucial for businesses in California. Employers must stay up-to-date with ongoing obligations to ensure proper coverage and protection for their employees.

Conclusive Thoughts

In conclusion, understanding and adhering to workers compensation insurance california requirements is vital for businesses to operate smoothly and safeguard their workforce. By staying informed and proactive, employers can ensure a secure and productive work environment for all.

FAQ Insights

Which types of businesses in California are required to have workers’ compensation insurance?

All businesses with employees, including part-time and temporary workers, are required to carry workers’ compensation insurance in California.

What are the consequences for employers who fail to provide workers’ compensation insurance in California?

Employers who do not provide workers’ compensation insurance can face penalties, fines, and even legal action, in addition to being liable for employee injuries or illnesses.

How does the number of employees impact the requirement for workers’ compensation coverage in California?

The number of employees directly influences the need for workers’ compensation coverage, with businesses having one or more employees required to provide this insurance.

What are the minimum coverage limits mandated by California law for workers’ compensation insurance?

California law mandates minimum coverage limits for workers’ compensation insurance, ensuring that employees receive adequate benefits in case of work-related injuries or illnesses.

How can factors like business size and industry affect the cost of workers’ compensation insurance in California?

Factors such as the size of the business, the industry it operates in, and the safety record of the company can impact the cost of workers’ compensation insurance in California.